” As Inflation Starts To Climb, Biden Seems Unconcerned, About The Future.”

May 21, 2021 By Quera L. Knight & Art Fletcher, Reporting For: Englebrook Independent News

With last month’s low job numbers, and President Biden’s current spending, and inflation rates slowly increasing. America is on a path to repeat history.

Biden’s continues to report that the economy is stronger than ever, and he is increased job grow by millions, when the facts revealed america is heading back to the late 1970’s.

Inflation can be defined as the decline of purchasing power of a given currency over time. In terms of the economy, inflation is the powerful force that explains why one can no longer purchase a loaf of bread with a nickel, why comic book are no longer 35 cents, and why $5 can purchase a gallon of milk. As a consumer, it is what propels the strategy of making your dollar stretch.

Understanding the effects of inflation is only the first step to honing your purchasing power as a consumer of our economic market. The next concept in understanding inflation is the factors that cause it.

In a microeconomic perspective, every decision made within the market, albeit supply or demand, manufactures or consumers; all changes made would theoretically affect inflation. Fortunately, macroeconomics combined with econometrics allows us an aggregated perspective of these infinite changes. This provides the opportunity to highlight patterns and draw conclusions. From this process, economists have popularized three situation types that push inflation.

1. Demand-Pull Effect

2. Cost-Push Effect

3. Built-In Effect

The Demand-Pull effect is notable by increasing the supply of money at a faster rate than the increase of production. The average consumer has more money to spend, but without products and services to spend on, sellers of goods increase their prices. In contrast, the Cost-Pull effect also results in increased prices of ordinary goods, however it is fueled by an increase in cost of production. Lastly, the Built-In effect influences inflation through the mindset of consumers and workers. Plainly, people expect prices to go up and therefore demand wages and salaries that will compensate.

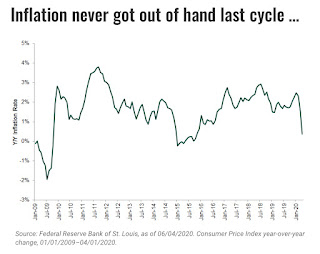

There has been recent scares of inflation mimicking that of the Carter Administration, a time period that created a legacy called The Great Inflation. Outside of monetary policy, on of the biggest influence of the 1970’s Great Inflation was stagnated economic growth; a result of steadily increased unemployment.

As the world tries to return to a functional equilibrium post pandemic, there is a valid cause for concern, economic harm due to inflation. Consumers have already seen prices increase on precious commodities like gas and oil prices. There has also been no decline in government stimulus payments. The pandemic has uprooted the lives of entire society, and government assistance should be expected from the people. As an educated consumer, we should also expect our government to take into consideration Demand-Pull effect when authorizing stimulus plans and payments.

One more factor to take into consideration before forming your own conclusion on where inflation is headed, the fuel of the Great Inflation, unemployment. Although we are under 8% average unemployment rate, the U.S. Bureau of Labor Statistics reports that April 2021’s unemployment rate of 6.1% was not only an increase from March, it is higher than the forecasted 5.8%.

While these unemployment rates in isolation may not be concerning, what may be a potential red flag is the fact that the stimulus plans set in place had the expectation of a decline in unemployment. With the supply of money still increasing and unemployment rates rising, an educated consumer is right to question the future of inflation on our economy.